As tax season rolls around, many of us are either looking forward to a refund or bracing for that dreaded payment (as if we haven’t already contributed enough). With taxes eating into our hard-earned money, it’s easy to feel frustrated, especially considering how much varies depending on where you live. But did you know that not all income is taxed the same way? While most of us spend our lives earning money through active income, many don’t realize that diversifying income sources could help you keep more of what you earn. Understanding the different types of income and how they’re taxed is key to creating a more effective financial strategy.

In this guide, we’ll break down the three main types of income, how they are taxed, and why shifting your focus from active income can make a big difference for your financial future.

Table of Contents

Summary: The 3 Main Types of Income

There are three primary types of income:

- Active Income: Money earned through work, such as wages and salaries.

- Passive Income: Earnings from sources like rental properties and businesses in which you don’t materially participate.

- Portfolio Income: Income generated from investments, including capital gains, dividends, and interest.

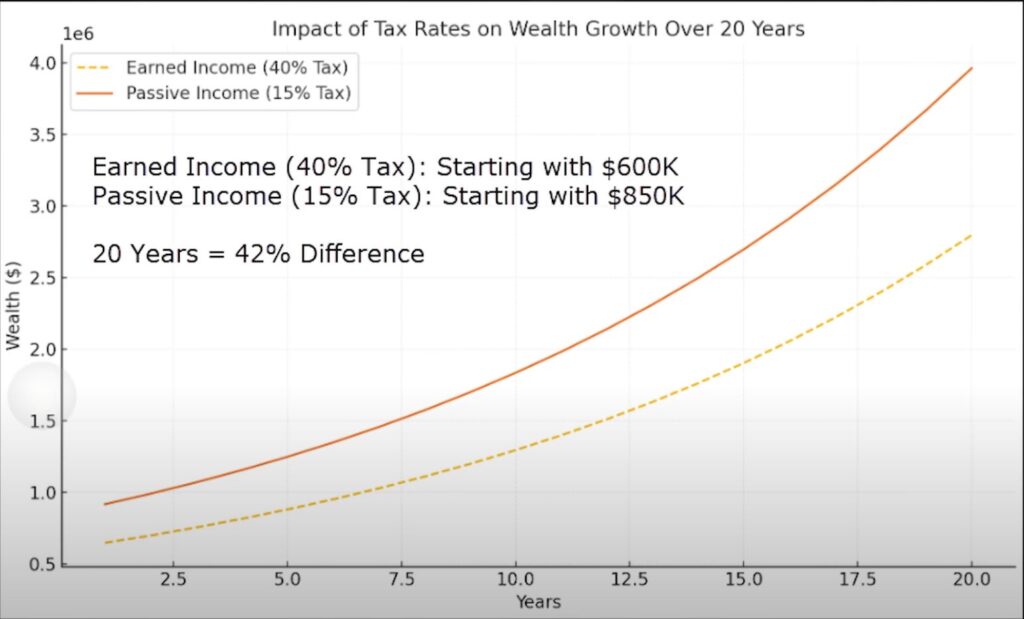

Each of these income types is taxed differently, and your goal should be to move as much of your earnings as possible away from active income and into passive and portfolio income to minimize taxes and maximize wealth.

1. Active Income (Also Called Earned Income)

Active income is what most people are familiar with. It includes:

- Salaries

- Wages

- Tips

- Commissions

- Self-employment income (if you materially participate in the business)

If you own a business, your income is considered active only if you materially participate, meaning:

- You work 500+ hours in the business per year.

- You do the majority of the work in the business.

- You work 100+ hours in the business, and no one else works more hours than you.

Taxation: Active income is taxed at federal and state income tax rates, which range from 10% to 37% at the federal level. Additionally, it is subject to Social Security and Medicare taxes, making it the most heavily taxed form of income.

2. Passive Income (Also Called Unearned Income)

Passive income includes earnings from sources where you do not actively work. Examples include:

- Rental income

- Royalties from books, music, or other intellectual property

- Affiliate marketing earnings

- Limited partnerships in businesses

Taxation: Passive income is taxed at a lower rate than active income, typically between 10% and 15%, depending on the source and tax bracket. However, passive income cannot be used to offset active or portfolio income losses.

3. Portfolio Income (Investment Income)

Portfolio income is money earned from investments, such as:

- Stock dividends

- Bond interest

- Real estate investment trust (REIT) income

- Capital gains from selling investments

A capital gain occurs when you sell an investment for more than you paid. For example, if you buy stock at $30 per share and sell it for $50, you earn a capital gain of $20 per share.

Taxation: Portfolio income receives preferential tax treatment because capital gains and dividends are taxed at a lower rate than earned income. Additionally, portfolio income is not subject to Social Security or Medicare taxes.

- Short-term capital gains (assets held less than a year) are taxed at your regular income tax rate.

- Long-term capital gains (assets held for over a year) are taxed between 0% and 20%, depending on your income level and filing status.

Why Active Income Is Costing You Money

Let’s put this into perspective:

- If you earn $100,000 from a traditional job (active income), it is subject to income tax, Social Security, and Medicare taxes. By the time all taxes are deducted, you might only take home $60,000–$70,000.

- If you instead earn $100,000 through a mix of passive and portfolio income, your tax burden is much lower—potentially saving you thousands of dollars each year.

This is why wealthy individuals focus on shifting their income sources. They aren’t making money the same way as the average worker. They are strategically earning through investments, real estate, and business ownership to minimize taxes and build wealth.

Tips to Lower Your Taxes & Improve Your Financial Future

Most people spend their entire lives earning only active income, retiring with little savings, and passing on poor financial habits to the next generation. But you don’t have to follow that cycle!

Start today by:

- Exploring ways to earn passive income (real estate, side businesses, royalties).

- Investing in stocks, bonds, and other portfolio income sources.

- Reducing reliance on active income to increase tax efficiency and long-term financial security.

By understanding and leveraging the different types of income, you can create a tax-advantaged strategy to grow your wealth faster and keep more of what you earn.

Closing Thoughts: Optimize Your Types of Income

Don’t let high taxes on active income drain your hard-earned money (that is literally what is happening!). The key to financial freedom is diversifying your income streams and moving toward tax-efficient earnings.

Take the first step today; your future self will thank you.

🚀 Explore, Learn & Grow with Wallet Monkey!

Unlock the latest tips, tricks, and expert insights on money management, credit, and more. Subscribe now and stay ahead of the curve in personal finance!

Subscribe NowFAQs

1. What is the difference between active and passive income?

Active income is earned through direct participation in work, such as wages, salaries, and commissions. Passive income, on the other hand, comes from sources like rental properties, royalties, and investments where little to no active participation is required. The primary difference lies in how much effort you put in to earn it and the tax rates applied to it.

2. How can I reduce taxes on my active income?

To reduce taxes on active income, consider contributing to retirement accounts like 401(k)s or IRAs, which can lower your taxable income. You can also explore tax deductions available for business expenses if you’re self-employed or look into tax credits for things like education or home energy improvements.

3. Is passive income taxed differently from active income?

Yes, passive income is typically taxed at a lower rate than active income. While active income is subject to federal and state income taxes as well as Social Security and Medicare taxes, passive income is generally taxed at lower rates, usually between 10% and 15%, depending on the type of income and your tax bracket.

4. How do capital gains taxes affect my portfolio income?

Capital gains taxes are applied to the profit you make from selling investments like stocks, bonds, or real estate. If you sell investments held for over a year, long-term capital gains are taxed at a reduced rate (0% to 20%) compared to short-term gains, which are taxed at your regular income tax rate. This makes portfolio income one of the most tax-efficient ways to grow wealth.

5. Can I combine active, passive, and portfolio income?

Yes, many people combine all three types of income to build wealth and reduce their overall tax burden. For example, you can earn a salary (active income), invest in stocks or bonds (portfolio income), and generate rental income or royalties (passive income). By diversifying your income streams, you can potentially lower your overall tax rate and increase your financial security.