Truist Bank, the result of the 2019 merger between BB&T and SunTrust, has quickly become one of the largest and most influential financial institutions in the United States. As customers increasingly look for banks that blend reliability, digital convenience, and competitive financial products, you may be wondering if Truist is the right choice for your banking needs. Well, you’re in the right place!

In this review, we’ll dive into the key services, benefits, and potential drawbacks of Truist Bank, helping you decide if it’s the perfect fit for your financial journey.

Table of Contents

Truist Bank Key Features

- Branches & ATMs: Over 2,100 branches and 3,000 ATMs across the U.S.

- Mobile & Online Banking: Intuitive digital banking app with bill pay, transfers, and mobile deposits.

- Customer Service: 24/7 support via phone, chat, and in-person assistance.

- Account Options: Personal and business checking, savings accounts, credit cards, loans, and wealth management.

Truist Bank Products & Services

Checking Accounts

Truist offers multiple checking account options, including:

- Truist One Checking: A flexible account with no overdraft fees and rewards for account holders who maintain higher balances.

- Student Checking: Designed for young adults with minimal fees and easy digital access.

Savings & Money Market Accounts

- Truist One Savings: A standard savings account with a low minimum balance requirement.

- Money Market Accounts: Offers higher interest rates for those who maintain larger balances.

Credit Cards

Truist provides a variety of credit cards, including cashback, travel rewards, and low-interest options.

Loans & Mortgages

- Personal and auto loans with competitive rates.

- Home mortgages and refinancing options with flexible terms.

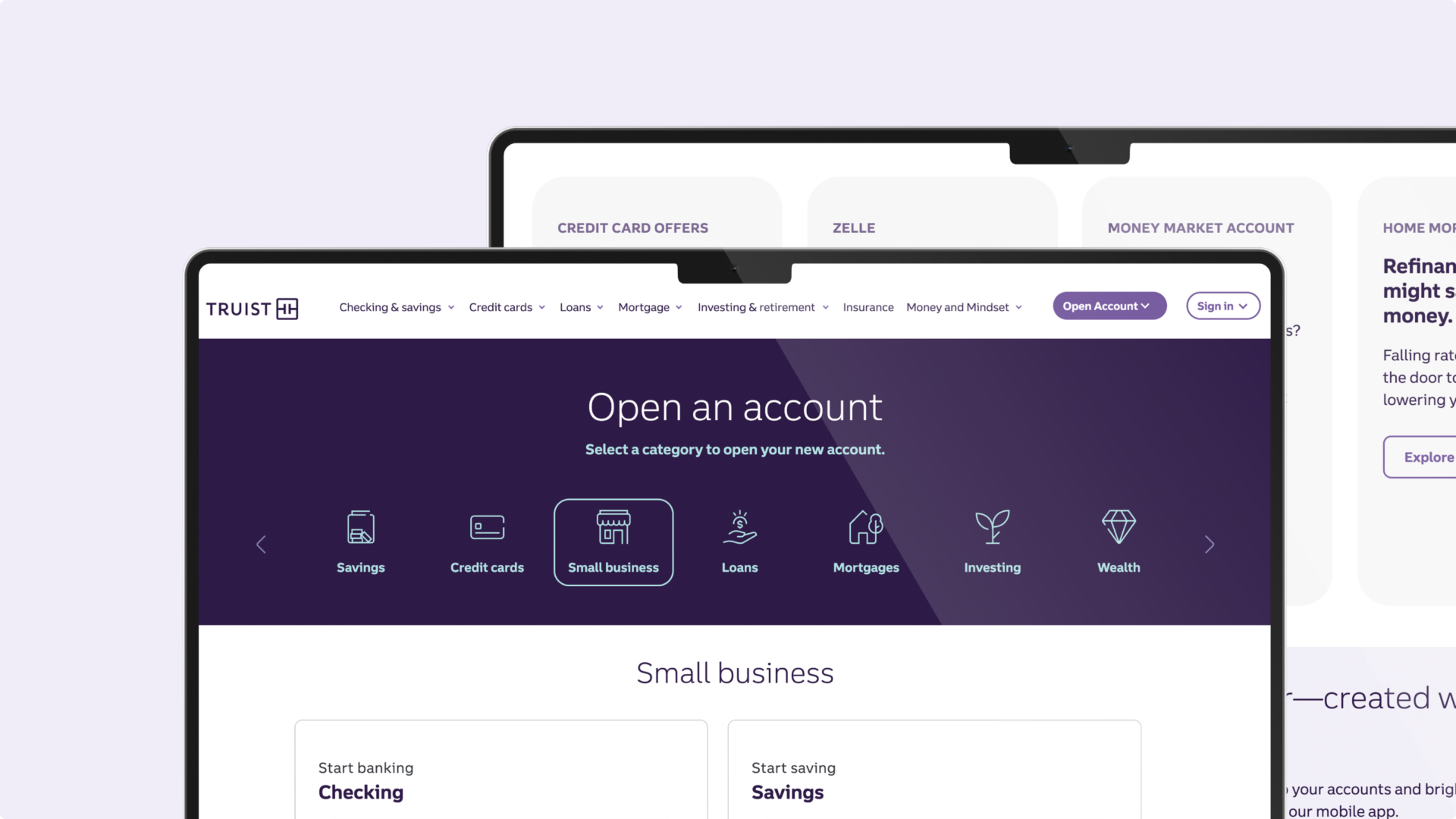

Business Banking

Truist supports businesses with:

- Business checking and savings accounts.

- Small business loans and lines of credit.

- Merchant services for payment processing.

For more info on their small business banking offerings, click here.

Pros & Cons of Truist Bank

Truist Bank Customer Experience

Truist’s mobile banking app is one of its strongest assets, offering features like Zelle transfers, mobile deposits, and budgeting tools. However, customer feedback on in-branch service and phone support varies, with some users experiencing delays in resolving account issues.

What People Are Saying About Truist on TrustPilot:

Rated 5 out of 5 stars

Sep 21, 2024

My experience at Truist Bank in North Fort Myers Florida was nothing but pleasant and very informative. Esty helped me and she was very thoughtful and informative. I highly recommend you go see her for all your banking needs.

Date of experience: September 20, 2024

Rated 3 out of 5 stars

Nov 14, 2024

The staff is very helpful. The tellers always greet me when I’m into the building. But Fridays and Saturdays is always long lines but overall will continue keep going back

Date of experience: November 15, 2024

Rated 1 out of 5 stars

Jan 21, 2025

My husband had an auto loan with Truist. The loan was paid off in early November 2024. The check was promptly deposited and as of mid January 2025, we are still waiting for the payoff letter and title to our vehicle. Numerous phone calls have been routed to wrong departments and issue is still not resolved. I would never recommend using this company again for any banking needs.

Date of experience: January 21, 2025

How Truist Bank Compares to Their Competitors

Final Verdict: Is Truist Bank Right for You?

Truist Bank can be a good choice for individuals and businesses looking for a full-service bank with strong digital tools and a large branch network. However, those seeking higher savings rates or the best customer service experience may want to explore alternatives.

🚀 Explore, Learn & Grow with Wallet Monkey!

Unlock the latest tips, tricks, and expert insights on money management, credit, and more. Subscribe now and stay ahead of the curve in personal finance!

Subscribe NowTruist Bank FAQs

1. Is Truist Bank a good bank?

Yes, Truist Bank is a reputable financial institution with a wide range of products, strong digital banking features, and a large branch network. However, interest rates on deposits could be more competitive.

2. Does Truist Bank charge overdraft fees?

No, Truist has eliminated overdraft fees on many of its checking accounts, including Truist One Checking.

3. What are Truist Bank’s hours of operation?

Most Truist branches operate Monday-Friday from 9 AM to 5 PM, with some locations open on Saturdays. Online and mobile banking is available 24/7.

4. How can I contact Truist customer service?

You can reach Truist customer support through phone (844-487-8478), online chat, mobile banking app, or by visiting a local branch.

5. Does Truist Bank offer free checking accounts?

While Truist One Checking has a monthly fee, it can be waived if you meet certain criteria, such as maintaining a qualifying balance or setting up direct deposits.

6. How do I open a Truist Bank account?

You can open an account online through Truist’s website, via the mobile app, or by visiting a local branch with the required identification and deposit.