*Disclaimer: This content is for informational purposes only and should not be taken as financial advice. Wallet Monkey may earn a commission from partner links in this article. Rates and offers are accurate as of publication but may change over time.

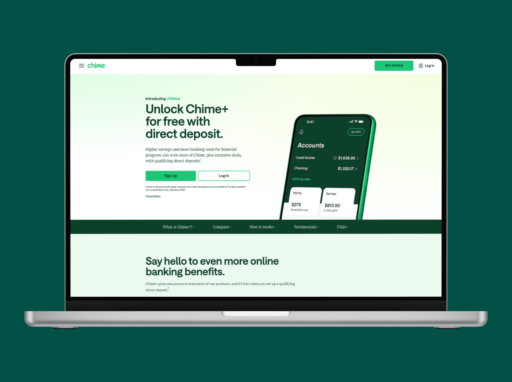

If you’re thinking about switching to Chime or just curious about how it compares to traditional banks, you’re not alone. Digital banking has grown a lot in recent years, and Chime is one of the biggest names in the space.

But with so many options out there, and a lot of marketing saturation, it can be tough to know what’s actually worth your time (and money). In this review, I’ll walk through how Chime Banking works, what it does well, where it falls short, and who it might actually be a good fit for.

This isn’t a paid plug or a sugarcoated overview; just an honest look at the pros and cons of Chime’s checking and savings accounts based on what real users care about in 2025.

Table of Contents

What Is Chime Banking?

Chime Banking is an online-only financial platform. It’s not a bank itself, but it partners with two FDIC-insured banks: The Bancorp Bank and Stride Bank, to provide checking and savings services.

What sets Chime apart is its focus on making banking more accessible and less fee-heavy. Everything is managed through the mobile app or website, and there are no physical branches. If you’re comfortable doing all your banking digitally, this might work in your favor. If not, it could be a dealbreaker.

What You Get with a Chime Checking Account

The Chime Checking Account, also known as a “Spending Account,” is the core of the platform. Here’s what it offers:

1. No Monthly Fees or Minimum Balance

There are no monthly maintenance fees, which is a relief if you’ve dealt with those before. You also don’t need to keep a minimum balance, which makes Chime accessible to people who are just starting out or rebuilding their finances.

2. Early Direct Deposit

If you set up direct deposit, Chime may let you access your paycheck up to two days early. It’s not guaranteed (it depends on your employer and payroll provider), but it’s a nice perk when it works.

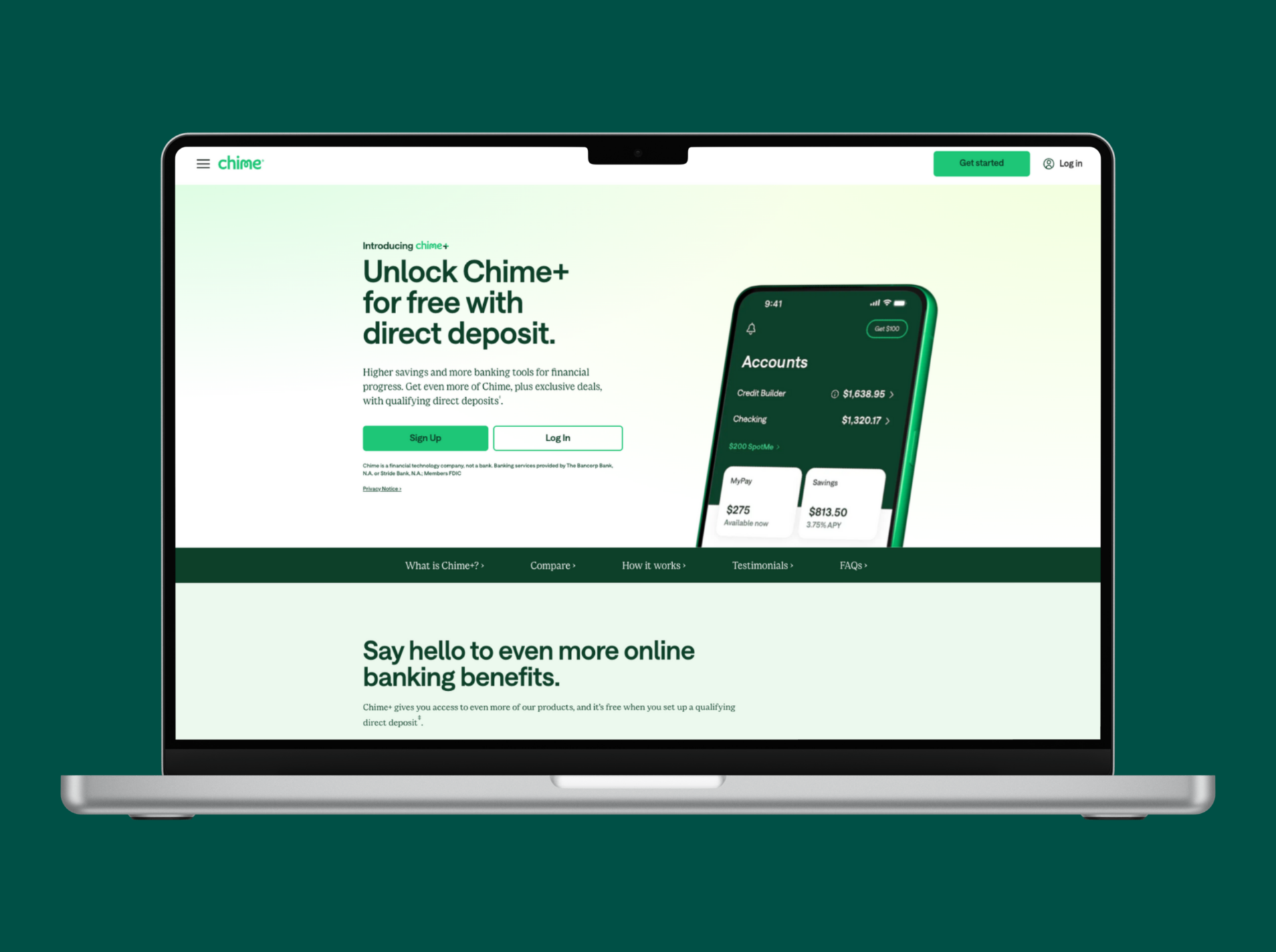

3. Fee-Free Overdraft with SpotMe

If you’re eligible (based on your direct deposit history), Chime can cover overdrafts up to $200 without a fee. This feature, called SpotMe, automatically kicks in when you overdraw on a debit card purchase. You just repay the balance when your next deposit hits.

4. Mobile-First Experience

Everything, from checking your balance to depositing checks to sending money to friends, happens in the app. It’s intuitive and user-friendly, which is more than can be said for some traditional bank apps.

5. No Foreign Transaction Fees

If you travel or make purchases from international retailers, Chime doesn’t charge foreign transaction fees. That’s useful, but keep in mind it still uses Visa’s exchange rates.

Important Note: Chime doesn’t offer checkbooks. If you need to send a paper check (for rent, for example), you’ll have to use their in-app “Mail a Check” feature. It works, but it’s not instant.

What to Expect from the Chime Savings Account

Chime also offers a High-Yield Savings Account, but you can only open one if you already have a Chime Checking Account.

Here’s what to expect:

1. 1.25%-3.75% APY (as of 2025)

You can earn 1.25% on your savings balance; if you upgrade to Chime+, you can earn an APY of 3.75%. The interest rate is competitive with other online savings accounts. It’s not the absolute highest out there, but it beats most brick-and-mortar banks by a mile, considering it’s 3x more than the national average.

2. Automatic Saving Tools

You can choose to round up every debit card purchase to the nearest dollar and move the change into savings. You can also have a percentage of your direct deposit go directly into your savings account. These features work well if you’re trying to build a habit of saving consistently.

3. No Fees or Minimums

Just like the checking account, the savings account has no monthly fees and no minimum balance requirements.

Pros and Cons of Chime Banking

Like any financial tool, Chime Banking has upsides and trade-offs. Here’s a quick breakdown:

How to Deposit or Withdraw Cash with Chime

This is where some people run into friction. Since Chime has no physical branches or ATMs of its own, cash deposits are only available at select retailers like CVS, Walgreens, and Walmart. These retailers often charge a fee (usually around $3.95), which isn’t ideal.

For withdrawals, Chime offers access to over 60,000 fee-free ATMs. If you need to withdraw from an out-of-network ATM, there’s a $2.50 fee.

Is Chime Safe to Use?

Yes. Even though Chime Banking is a fintech company, your money is FDIC-insured up to $250,000 through its partner banks. The app also uses encryption, multi-factor authentication, and real-time transaction alerts to keep your information secure.

Who Should Use Chime, and Who Might Want to Pass?

Chime might be a good fit if you:

- Want to avoid fees

- Mostly bank online

- Get paid by direct deposit

- Need help building savings

- Don’t deal with cash often

But Chime may not be the best option if you:

- Need in-person customer service

- Regularly deposit cash

- Want joint accounts or small business banking

- Rely on paper checks

Chime does a good job keeping things simple, but if you have more complex banking needs, you might outgrow it.

Chime vs. Other Online Banking Competitors

If you’re shopping around for a better banking experience, it helps to see how Chime measures up to similar platforms. Below is a side-by-side comparison of Chime, SoFi, Ally, and Current, all popular options in the digital banking space.

| Feature | Chime | SoFi | Ally Bank | Current |

|---|---|---|---|---|

| Monthly Fees | $0 | $0 | $0 | $0 |

| Overdraft Protection | Yes (SpotMe, up to $200) | Yes (up to $50) | Yes (limited overdraft transfer) | Yes (up to $200) |

| APY on Savings | 1.25%-3.75% | 3.80% (with direct deposit) | 3.50% (on savings account) | 4.00% (on up to $6,000 balance) |

| Early Direct Deposit | Up to 2 days early | Up to 2 days early | Up to 2 days early | Up to 2 days early |

| Cash Deposits | Yes (via retailers, fee may apply) | Yes, (via participating retail locations) | No (mainly ACH/check) | Yes (via participating retailers) |

| ATM Access | 60,000+ fee-free ATMs | 55,000+ fee-free ATMs (Allpoint) | 75,000+ (Allpoint) | 40,000+ fee-free ATMs |

| Joint Accounts | No | Yes | Yes | No |

| Check Writing | No checkbook (app-sent checks) | Yes | Yes | No |

| Best For | Simplicity & low fees | High-interest savers & borrowers | Full-service online banking | Teens & mobile-first users |

Final Thoughts: Is Chime Worth It in 2025?

If you’re looking for a basic checking and savings option with no monthly fees, a user-friendly app, and a few helpful features like early direct deposit and automatic savings, Chime Banking is worth a look.

It’s not perfect, and it’s definitely not built for everyone, but it could be a solid choice if you’re looking to simplify your finances and don’t need all the extras that come with a traditional bank.

Just make sure you’re okay with the online-only model and are comfortable using your phone to manage everything. If that’s you, Chime might check all the right boxes.

FAQs About Chime Banking

1. Does Chime charge any hidden fees?

No. Chime is pretty transparent about fees. There are no monthly maintenance fees or overdraft fees (if you use SpotMe). But you might run into third-party fees when depositing cash or using out-of-network ATMs.

2. How does Chime’s SpotMe feature work?

If you’re eligible, Chime will spot you up to $200 on debit card purchases with no overdraft fees. You’ll repay the negative balance when your next deposit arrives.

3. Can I use Chime if I get paid in cash?

You can, but cash deposits aren’t super convenient. You’ll need to visit a participating retailer, and many charge a fee. It’s something to consider if you deal with cash often.

4. Is Chime Banking Legit?

Yes, Chime Banking is legit. While Chime itself isn’t a bank, it partners with FDIC-insured institutions (The Bancorp Bank and Stride Bank), which means your money is protected up to $250,000. It also uses strong security features like two-factor authentication and real-time alerts to help keep your account safe.

5. How do I withdraw cash from my Chime account?

You can withdraw cash from your Chime account by using one of their 60,000+ fee-free in-network ATMs, getting cash back at participating retailers like Walmart or CVS when making a debit purchase, or by requesting an over-the-counter withdrawal at a bank or credit union (which comes with a $2.50 fee). The daily withdrawal limit is typically $515.

Top Relevant Articles

*Editorial Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial, investment, or legal advice. Wallet Monkey aims to provide accurate and up-to-date information, but we encourage readers to verify details directly with financial institutions. Some of the products mentioned may be from Wallet Monkey partners, which may influence how they appear. However, our recommendations are based solely on what we believe provides genuine value to readers.