The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

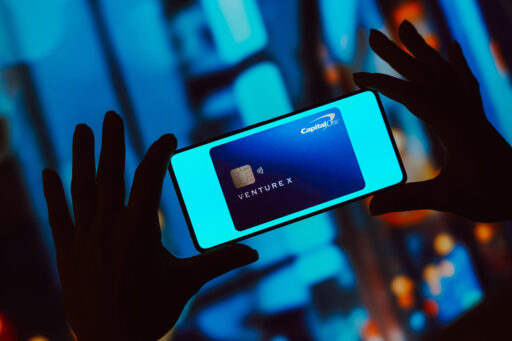

The Capital One Venture X Rewards Credit Card made a big splash when it launched, and in 2025, it’s still one of the most talked-about travel cards on the market. But is it really worth the hype? Or are there better options out there for frequent travelers?

In this honest review, we’ll break down what’s great about the Venture X, what’s not so great, and whether it’s the right fit for your wallet this year.

Table of Contents

What Is the Capital One Venture X Rewards Credit Card?

The Venture X is Capital One’s premium travel credit card. Think of it as the luxury version of their popular Venture Rewards card. It’s designed for people who travel often and want solid rewards, premium benefits like airport lounge access, and decent travel protections.

What makes the Venture X different from other high-end cards is that it offers a lot of the same perks as more expensive competitors, but at a much more reasonable annual fee.

What We Like About the Venture X Credit Card

Let’s start with what the Venture X does well. There’s actually quite a bit.

1. Strong Welcome Bonus

New cardholders can currently earn 75,000 miles after spending $4,000 in the first three months. That’s worth at least $750 toward travel, and potentially more if you transfer miles to travel partners.

2. Simple, Flexible Rewards

You earn:

- 10X miles on hotels and rental cars booked through Capital One Travel

- 5X miles on flights booked through Capital One Travel

- 2X miles on everything else

There’s no confusing bonus categories to track, and the flat 2X rate on general purchases makes it easy to rack up points.

3. Airport Lounge Access

This card gives you unlimited access to Capital One Lounges, plus access to Priority Pass lounges (over 1,300 locations worldwide). If you travel even a few times a year, this perk alone can be a game-changer.

4. $300 Annual Travel Credit

You’ll get up to $300 in statement credits when booking through Capital One Travel each year. If you already plan to book flights or hotels, this goes a long way toward offsetting the card’s $395 annual fee.

5. 10,000 Bonus Miles Every Year

Starting on your first anniversary, you’ll receive 10,000 bonus miles each year you keep the card, worth around $100 toward travel. Again, this adds real value if you’re planning to keep the card long term.

What We Don’t Love About the Venture X Credit Card

No card is perfect. Here are a few things to consider before you apply.

1. You Have to Book Through Capital One Travel to Maximize Benefits

To get the 10X and 5X rewards (and use the $300 travel credit), you need to book through Capital One Travel. While the platform is solid, some people prefer booking directly with airlines or hotels for better customer service or elite status recognition.

2. Annual Fee Still Isn’t “Cheap”

Yes, the $395 annual fee is lower than competitors like the Chase Sapphire Reserve or Amex Platinum, but it’s still a significant cost. If you don’t travel much, it may be hard to justify.

3. No Transfer Bonuses (Usually)

Capital One allows you to transfer miles to several airline and hotel partners, which can be great for maximizing value. However, unlike some other issuers, Capital One rarely offers transfer bonuses, which means you might not get as much out of your points as you would with, say, Amex Membership Rewards or Chase Ultimate Rewards.

Who Should Get the Venture X?

The Capital One Venture X is best for:

- Frequent travelers who value lounge access, annual credits, and simple rewards

- People who want premium perks without paying a $600+ annual fee

- Those who book flights and hotels online and are comfortable using a travel portal

- Fans of flexible miles that can be used for travel purchases or transferred to partners

Who Should Skip It?

You might want to look elsewhere if:

- You travel rarely or prefer cashback over miles

- You value airline or hotel elite status and always book directly

- You want maximum value from points transfers and seek frequent transfer bonuses

How Does Capital One Venture X Compare to Competitors?

Final Verdict: Is the Venture X Worth It in 2025?

Yes, if you travel even moderately, the Capital One Venture X Rewards Credit Card is still one of the best premium credit cards in 2025.

It offers excellent value for its price, with travel credits and anniversary bonuses that effectively cancel out most of the annual fee. Add in lounge access and simple, flexible rewards, and it’s a very strong contender.

That said, if you’re not booking travel often or prefer cash back, this may not be the card for you.

FAQs

1. How much are Capital One miles worth?

Generally, Capital One miles are worth 1 cent each when redeemed for travel through their portal. You may get more value by transferring to airline or hotel partners.

2. Does the Venture X have foreign transaction fees?

No. Like most travel cards, there are no foreign transaction fees.

3. Is lounge access really unlimited?

Yes. Venture X cardholders get unlimited visits to Capital One Lounges and Priority Pass locations.

4. Can I downgrade the card if I decide it’s not worth it?

Yes, Capital One may allow you to downgrade to a no-annual-fee card like the VentureOne, depending on your account history.

5. Is Venture X better than Chase Sapphire Reserve?

It depends. Venture X is more affordable and simpler. Sapphire Reserve has more robust travel protections and stronger point transfer partners. It comes down to personal travel habits and preferences.

🚀 Explore, Learn & Grow with Wallet Monkey!

Unlock the latest tips, tricks, and expert insights on money management, credit, and more. Subscribe now and stay ahead of the curve in personal finance!

Subscribe Now