If you’re a regular at TJ Maxx, Marshalls, HomeGoods, or Sierra, chances are you’ve been offered the TJ Maxx Credit Card at checkout. But is it really worth adding to your wallet in 2025?

Let’s dive into everything you need to know: perks, drawbacks, how it works, and whether it’s the right choice for your financial goals this year.

Table of Contents

TJ Maxx Credit Card Overview

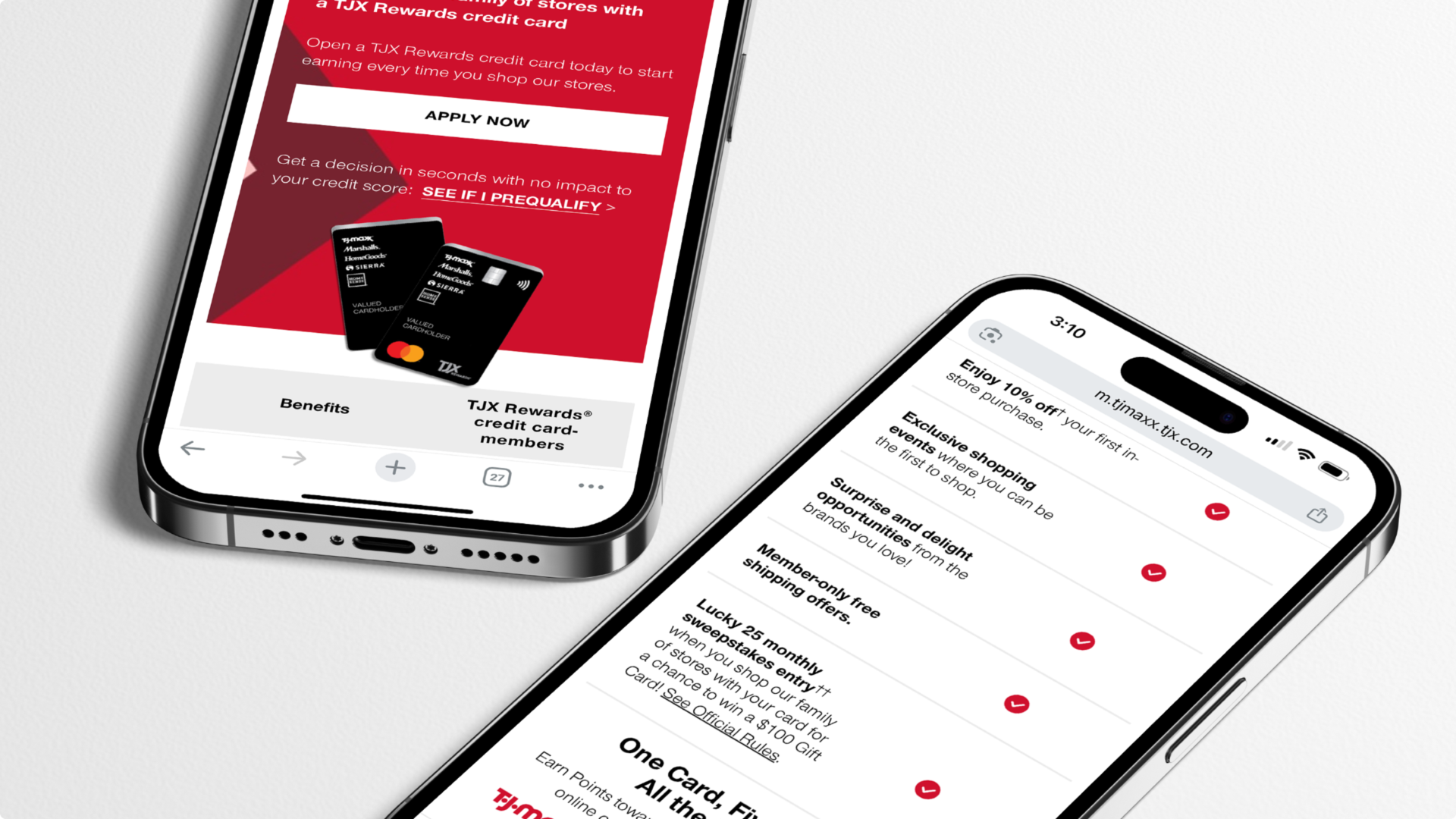

The TJ Maxx Credit Card is a store credit card issued by Synchrony Bank, and it comes in two versions:

- TJX Rewards® Credit Card: It can only be used at TJX family stores (TJ Maxx, Marshalls, HomeGoods, Sierra, and Homesense).

- TJX Rewards® Platinum Mastercard®: It can be used anywhere Mastercard is accepted.

Which one you get depends on your credit profile. Applicants with higher credit scores are more likely to qualify for the Mastercard version.

TJX Rewards Card vs TJX Rewards Mastercard

Pros and Cons of the TJ Maxx Credit Card

Who Should Consider the TJ Maxx Credit Card?

This card is best for:

- Loyal TJX shoppers who spend at least $100–$200/month at TJ Maxx, Marshalls, Sierra, or HomeGoods.

- People who pay off their balance in full each month (to avoid the high interest).

- Shoppers who want simple, store-specific rewards with no annual fee.

Who Should Skip the TJ Maxx Credit Card?

You might want to pass if you:

- Prefer cashback or travel rewards.

- Frequently carry a balance from month to month.

- Don’t shop at TJX stores regularly.

- Want a card that helps build credit across a broader range of purchases.

How to Apply for the TJ Maxx Credit Card

You can apply:

- In-store at any TJ Maxx, Marshalls, or HomeGoods location.

- Online via the official TJX Rewards Credit Card site.

Be ready to provide your basic info and consent to a hard credit pull.

What Credit Score Do You Need for the TJX Credit Card?

- For the store-only version, you can typically get approved with fair credit (around 620–660).

- For the Platinum Mastercard, you’ll usually need good credit (680+).

Keep in mind that approval also depends on your income, credit history, and debt-to-income ratio.

How Do TJ Maxx Credit Card Rewards Work?

Here’s how it breaks down:

- You earn 5 points per $1 at TJX stores.

- Mastercard users earn 1 point per $1 on other purchases.

- Once you hit 1,000 points, you receive a $10 Rewards Certificate, valid at any TJX store.

- Certificates are usually auto-mailed or added to your account monthly.

Alternatives to the TJ Maxx Credit Card

Final Verdict: Is the TJ Maxx Credit Card Worth Getting in 2025?

The TJ Maxx Credit Card can be a smart choice if you’re a loyal shopper at TJ Maxx, Marshalls, HomeGoods, or other TJX stores, and you always pay off your balance in full. With 5% back in rewards, exclusive shopping perks, and no annual fee, it’s designed to reward consistent spending within the TJX family.

However, if you’re looking for more flexible rewards, lower interest rates, or broader usage across multiple retailers, this card likely isn’t the best fit. The high APR and limited redemption options make it more suitable as a secondary card for brand loyalists, not as a go-to everyday card.

Bottom line: Like most store credit cards, the TJ Maxx Credit Card is worth considering in 2025 if you shop at TJX stores often and can avoid carrying a balance. For everyone else, a general rewards credit card may offer better long-term value.

🚀 Explore, Learn & Grow with Wallet Monkey!

Unlock the latest tips, tricks, and expert insights on money management, credit, and more. Subscribe now and stay ahead of the curve in personal finance!

Subscribe NowFAQs

1. Can I use the TJ Maxx Credit Card at Marshalls or HomeGoods?

Yes! You can use it at TJ Maxx, Marshalls, HomeGoods, Sierra, and HomeSense.

2. Does the TJ Maxx Credit Card help build credit?

Yes, if used responsibly. Synchrony Bank reports to the three major credit bureaus, so paying on time and keeping your balance low can help your credit score.

3. Is the TJ Maxx Credit Card hard to get?

It’s not too hard to qualify, especially for the store-only version. Good credit improves your chances of getting the Mastercard.

4. Can I get pre-approved for the TJ Maxx Credit Card?

As of 2025, TJX does not offer pre-approval online. You’ll need to apply and undergo a hard credit inquiry.

5. Do TJ Maxx Rewards expire?

Yes. Rewards Certificates typically expire after two years, but it’s best to check the specific expiration date on your account or mailed certificate.

![Capital One Venture X Rewards Credit Card [2025 Review]](https://blog.walletmonkey.com/wp-content/uploads/2025/05/Capital-One-Venture-X-Rewards-Credit-Card-2025-Review-512x341.jpeg)